Most of us know that we need to invest our money in the stock market to grow our money. Even when interest rates weren’t close to zero like they are now, the stock market was a good place to be. In fact, over time, the stock market is a useful tool in building wealth, so long as you stay the course and invest for the long-term. But there is more you can do than just invest your money to grow it, you can use tax efficient investing to keep more of your money too.

Most of us know that we need to invest our money in the stock market to grow our money. Even when interest rates weren’t close to zero like they are now, the stock market was a good place to be. In fact, over time, the stock market is a useful tool in building wealth, so long as you stay the course and invest for the long-term. But there is more you can do than just invest your money to grow it, you can use tax efficient investing to keep more of your money too.

By being smart about your investing strategy and keeping tax efficiency in mind, you can keep more of your money from Uncle Sam. I know I can’t be the only one who isn’t a fan of forking over my hard earned dollars. So below is an outline of how you can get started with tax efficient investing. Don’t worry, it’s a lot easier than it might sound.

What Is Tax Efficient Investing?

First off, we need to make sure everyone understands what tax efficient investing is all about. In a nutshell (help, I’m in a nutshell! Sorry, couldn’t resist), it means strategically investing in a way that ensures you pay the least amount of tax possible.

To do this, you fund certain types of accounts before others and you place certain investments in each of these accounts strategically so that you can take advantage of the tax code. And taking advantage of the tax code is our ultimate goal.

How To Get Started With Tax Efficient Investing

Now that we have a basic idea of tax efficient investing, we can talk about how to get started. Before you start thinking about your investments strategically however, you need to have a plan. Without a plan, you are sunk, so take the time to set up a long-term investing plan. Having this document will ensure greater success when turmoil hits, and trust me, it will.

Luckily, I’ve already written about developing and setting up such a plan. You can read this post to get started. Don’t worry, we’ll still be here when you get back.

So let’s get started. We will first look at accounts and then specific investments.

Tax Efficient Investing – Account Level

Retirement Accounts – 401k Plan

On an account level, you should be funding retirement (also called non-taxable) accounts before you fund non-retirement accounts (also called taxable accounts). If you are covered by a 401k plan at work, it is important that you put as much money into this account as possible. The reason for this is because every dollar you contribute lowers your taxable income.

It works like this: When you get paid, your employer first takes out any 401k contribution you are making. Then whatever is left over, you get taxed on. I realize you have other deductions, but I am ignoring them here as I am looking to keep things simple.

For example, if your weekly gross paycheck is $1,000 and you do not invest in a 401k plan, you will be paying $235 in federal taxes every paycheck. If on the other hand, you put $100 into your 401k plan each week (10%), you would pay $210 in taxes and have $100 saved for retirement.

Notice what happened there? By contributing to a 401k, you reduced the taxes you paid by $25 (from $235 to $210). I know that number isn’t as sexy as the tax refund you probably get, but it should be.

The problem that many people make is that they are focusing in on their net pay. With zero 401k contributions, your take home pay is $765 week. With a 401k contribution, your take home pay is $690. They don’t see that:

- They saved $25 on taxes and will continue to save more on taxes as they continue to invest

- That they saved $100 yet their take home pay is only $75 less than what it would be without a 401k contribution.

I encourage you to visit this site and play around with the calculator. It’s easy to use and you will see just how much you can save on taxes just by contributing to your 401k plan and the effect it will have on your take home pay.

Retirement Accounts – IRAs

While your 401k plan is the granddaddy of retirement plans when it comes to taxes, you also have individual retirement accounts (IRAs), both Traditional and Roth. The main difference between the two are that with a Traditional IRA, your money grows tax deferred, meaning you only pay taxes on the money when you take it out, while with a Roth IRA, your money grows tax free, meaning you never pay taxes on the money while in the account or when you withdraw it.

Some people are in favor of one over the other, but having both makes sense since they both provide different benefits. It is in your best interest to talk to your tax advisor about which one makes the most sense for you, your needs and goals.

In the case with a 401k and IRAs, the added benefit is that the money in these account grows tax deferred (tax free in the case of the Roth IRA). This means that anytime you sell a holding for a gain, you pay zero taxes on it. Additionally, whenever a holding pays interest, dividends or capital gains, these too are free from tax.

So again, with retirement (or non-taxable) accounts, we have:

- 401k Plan

- Traditional IRA

- Roth IRA

These accounts should be funded first, since in certain cases, the money you save escapes taxes and the money in these accounts grows tax-free forever, or until you withdraw the money.

Retirement Accounts – Health Savings Account

This account isn’t really a retirement account, but many people, including myself, use our health savings accounts as de-facto Roth IRAs. Therefore, I am going to briefly touch on them.

Basically, you fund your HSA and then use out-of-pocket money to pay for your medical expenses now. You let the money in your HSA account stay invested and grow for the next 20+ year’s tax free. When you are older, you then use that money to pay for medical bills.

You can read more information about this strategy in this post I wrote.

Taxable Accounts

Many investors also invest in a taxable account. This is an account that is not tied to retirement in the way the IRS looks at it. This means you are free to withdraw money, without penalty, whenever you feel like it. It also means it doesn’t have the favorable tax treatment like retirement accounts either.

Basically, a taxable account gets taxed whenever there is an “event” in the account. An event includes a sale, dividend payment, interest payment or capital gain. It is important to know that even if you reinvest dividends and/or capital gains, you still pay tax on that income.

Therefore, most of your investing money should first go into retirement accounts before you put that money into a taxable account because of the fact that the money grows in the retirement accounts without dealing with taxes.

A typical plan should be:

- Fund 401k to the max

- Fund a Traditional/Roth IRA to the max

- Fund a taxable account

Where To Invest Assets

Now that you know how to fund your accounts for the most tax efficient investing, you need to know which investments to place into these accounts as this makes a difference as well. This is because different assets and their income are taxed differently.

Therefore, it is important to understand how these things are looked at income-wise. I am not going to get too technical with taxes for you, just lay out the basics. Depending on the type of income a holding pays, determines how much you pay in taxes. Here is the breakdown:

- Dividends: depends

- Bond Interest: ordinary income

- Capital Gains: taxed as short or long term

I’ll go into a little more detail with each one of these so that you understand the tax treatment of each.

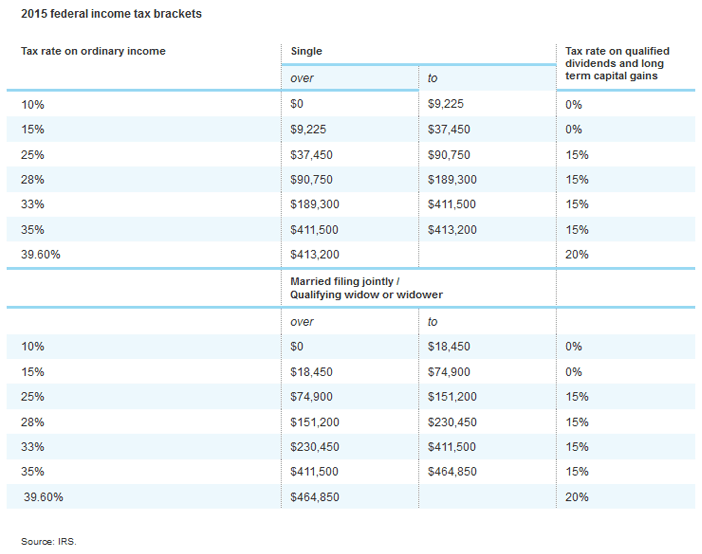

Dividends: Dividends are either ordinary or qualified. If they are ordinary, then the tax you pay is ordinary income, which is the same tax you pay on your work income, meaning a higher tax as you make more/earn more dividend income. But if the dividend is qualified, then the most tax your pay on it is 15%. What makes a dividend qualified?

It’s a few things, including where the company is located, if it is traded on a US market and how long you held the stock for. What you need to know though is that if you “chase dividends” meaning you are buying stocks right before they declare a dividend, then you are most likely paying ordinary income rates. But if you hold for the long-term, odds are you are going to have qualified dividends and pay a lower tax rate.

Bond Interest: Bonds pay out interest that is classified as ordinary income. Again, this is the same tax rate that you pay your income on, so the more bond interest and salary you make, the more income tax you will be paying.

Note though that some bond income is tax-exempt. This get tricky though because some income is tax-exempt from federal taxes and not state taxes, while other income is the other way around – taxable at the federal level but not the state. And in some cases, the income is tax exempt from both federal and state income tax.

Capital Gains: Depending on if the gain is short term (held less than one year) then you will pay a higher tax on that gain. As of this writing, any short term capital gains are taxed at ordinary tax rates.

If the gain is long term (held longer than one year) then you will pay a lower tax on that gain. Here is the breakdown on how these gains are taxed from the Schwab website:

Now, what exactly is a capital gain? If you buy Apple stock for $100 and sell for $105, then you have a capital gain of $5. The difference in when you bought and when you sold determines if it is short term or long term. So if you bought and sold within a year, it is a short term gain. Longer than one year, and it is a long term gain.

The issue with capital gains though is when you invest in mutual funds or exchange traded funds (ETFs). Here, you have no control over when the manager sells shares. Even though you personally didn’t sell, you still get paid out any capital gains that the fund experiences, so you could be in for a surprise come tax time.

So how do you invest so that you can limit your taxes in these instances? It’s a lot easier than it might sound. First off, the majority of any taxable bonds that you hold should be held within retirement accounts. Since the money in those accounts grows without tax consequences, whenever the bonds pay you interest, you never pay any taxes since they are in a retirement account.

This same idea holds true for any real estate investment trusts (REITs) that you own. They too pay ordinary income, so holding these in a retirement account is a smart move.

For dividends, the key really is to be a buy and hold investor, otherwise, as I pointed out above, if you trade too frequently, you are going to pay ordinary income tax rates. If you really want to chase dividends though, you could do so in a retirement account since those dividends won’t be taxed.

Just make sure you know what you are doing so that you don’t risk your retirement money. Also, be sure to take into account the commissions you are paying. It may not even be worth it if the commissions are high. (For the best low cost online broker for you, check out my comparison chart.)

When it comes to capital gains, there are a few things you can do:

- For stocks, try to hold until at least a year to get the more favorable tax treatment

- For mutual funds, look into “tax advantaged” mutual funds as well as index funds. These rarely will pay capital gains.

- For exchange traded funds, again, look into index ETFs. I know that iShares ETFs rarely pay capital gains and they tout this accomplishment.

Final Thoughts – Action Steps

So there you have it. A guide to tax efficient investing. As a quick recap:

- Invest in retirement accounts, then non-retirement accounts

- Put investments that pay ordinary income into retirement accounts

- Hold dividend paying securities for the long term to take advantage of lower tax rates

- Invest in “tax managed” or index funds/ETFs to lower and possibly avoid capital gains

While you won’t “see” the results of following this strategy, you will allow more of your money work for your own good. What I mean by not seeing the results is that you won’t get a statement showing you how much you saved in taxes. It’s the same idea with management fees you pay. You don’t see them, but they are there and you need to take action so that you can keep more of your money.

And by keeping more of your money invested, it allows it to compound at a faster rate, which potentially opens the door for early (or earlier) retirement than you might have thought possible.

Readers, do you use any of these tax efficient investing strategies to keep more of your money?

The post Tax Efficient Investing – How To Keep More Of Your Money appeared first on MoneySmartGuides.com.